OUR SIGNALS IN DETAIL

Dymamic Drawdown Protection (DDP)

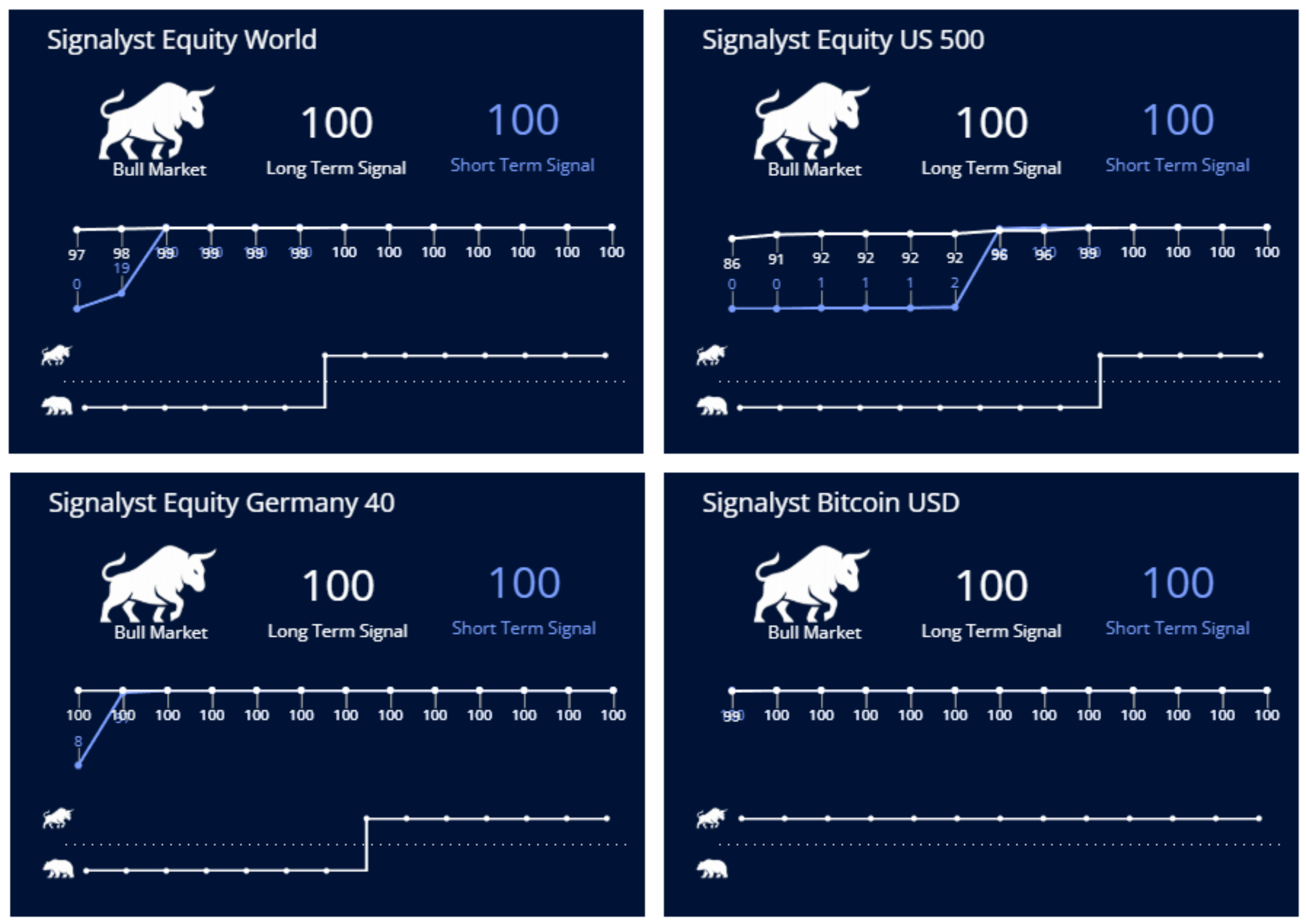

Three key signals for your investment decisions

Three key signals for your investment decisions

Our models distill the complexities of Bayesian change point detection into three intuitive, easy-to-use signals:

Market Phase Indicator: Shows whether the model views the market as being in a bull or bear phase. This binary indicator is derived from a combination of the Long-Term and Short-Term Signals.

Short-Term Signal: Highly responsive to recent market changes, offering quick insights.

Long-Term Signal: Focuses on stability and long-term trends.

view more details

view more details

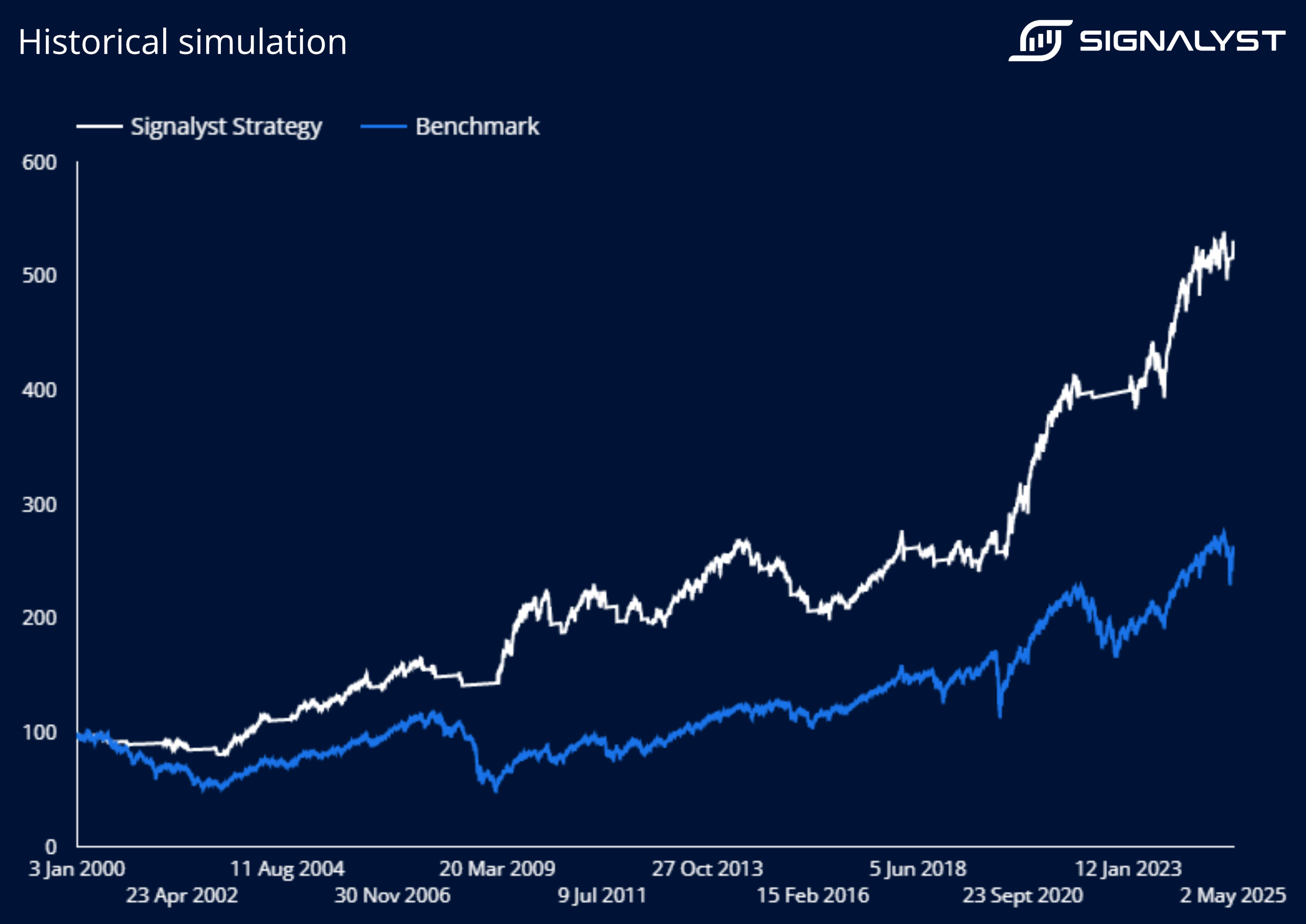

Signal based investment strategies

The signals can directly inform investment strategies. In our sample calculations, we used the market phase indicator to derive a simple strategy of long investment during bull markets and divestment during bear markets.

view more details

However, like all quantitative models, this strategy is not without periods of weaker performance. While the model works well in well-defined bull and bear markets, it can struggle to make the right calls in highly volatile sideways markets. Despite that, the approach demonstrates the ability to participate in market returns in the long run while reducing major drawdowns effectively.

Please note: The calculations shown here are historical simulations and do not represent live results. The goal of this simulation is to demonstrate the usage of the signals in a simple investment strategy. Actual implementation and investment decisions remain in the sole responsibility of the signal user. The signals represent a statistical interpretation of market data and should not be construed as investment advice under any circumstances.

view more details

However, like all quantitative models, this strategy is not without periods of weaker performance. While the model works well in well-defined bull and bear markets, it can struggle to make the right calls in highly volatile sideways markets. Despite that, the approach demonstrates the ability to participate in market returns in the long run while reducing major drawdowns effectively.

Please note: The calculations shown here are historical simulations and do not represent live results. The goal of this simulation is to demonstrate the usage of the signals in a simple investment strategy. Actual implementation and investment decisions remain in the sole responsibility of the signal user. The signals represent a statistical interpretation of market data and should not be construed as investment advice under any circumstances.

White Paper: Bayesian change point detection for dynamic allocation strategies

In this White Paper, our founder and Chief Product Officer, Dr. Tassilo Zimmermann, explains the basics of Bayesian Change Point Theory and its application in our signals.